DEMOGRAPHIC IMBALANC IN ADVANCED ECONOMIES

Most advanced economies increasing have an elderly population because they are not reproducing sufficiently to maintain or expand their population without immigration.

For the USA which has much land and resources, immigration is most natural way to continue to have a young workface to keep the economy expanding and support aging baby boomers.

(Actually, those over sixty, IF THEY WERE WELL ORGANIZED AND FOCUSED, could probably support all those over sixty who need it as I have argued elsewhere).

Another option is to use robots and AI to minimize the number of people needed in the work force.

by Tristan Gaudiaut,

Feb 3, 2026

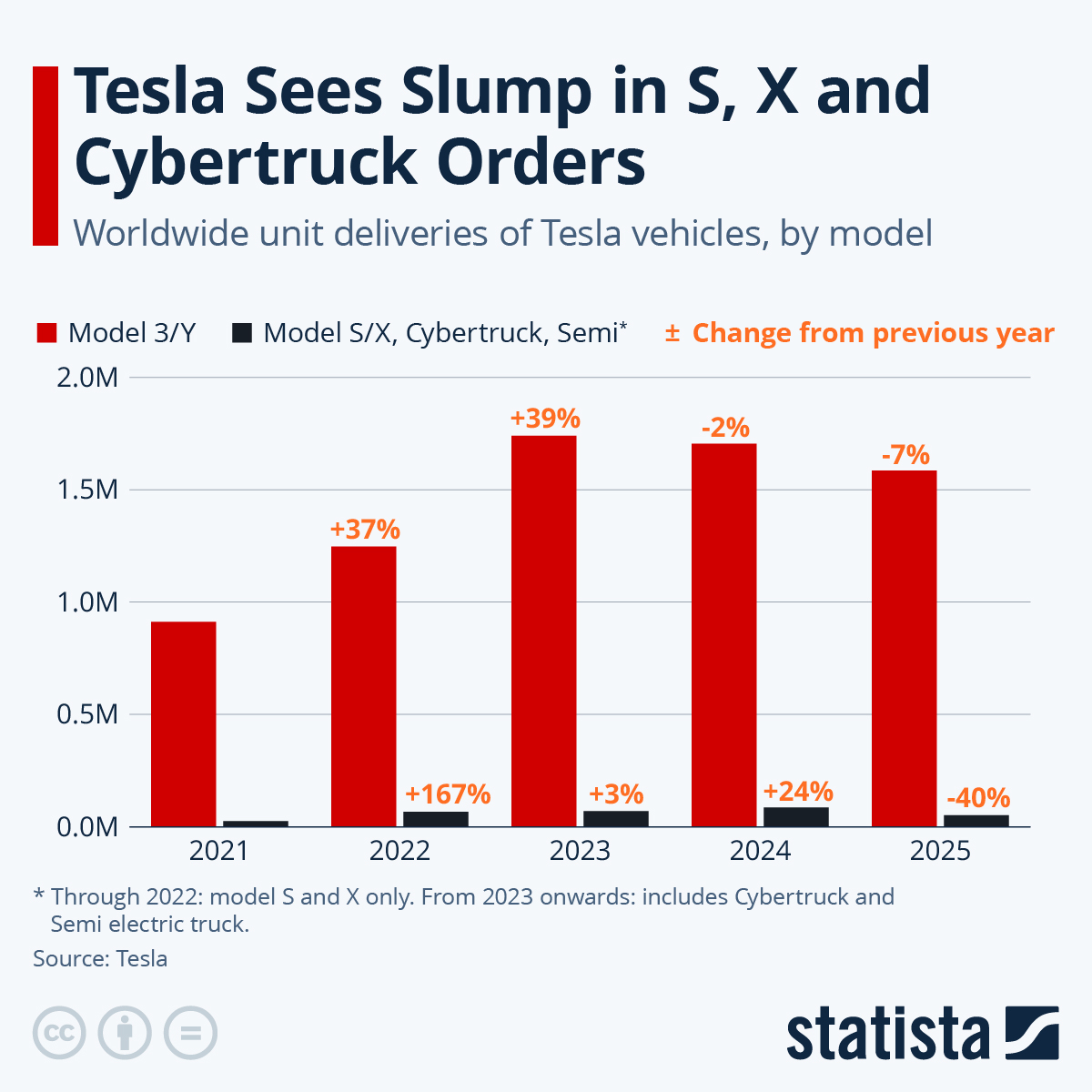

During Tesla's latest results presentation, CEO Elon Musk confirmed that the electric car company will discontinue its Model S and Model X in Q2 2026. The decision comes amid weakening demand at the top end of Tesla’s range. Our infographic based on Tesla figures shows that deliveries of the Model S, Model X and Cybertruck fell 40 percent year-on-year in 2025. Tesla still sells far more of its mass-market staples, the Model 3 and Model Y, but even those weren’t immune, posting a 7 percent global decline versus 2024, while the brand's appeal has fallen particularly sharply in Europe.

Since 2023, Tesla has stopped reporting Model S/X deliveries separately, bundling them with the Cybertruck and the Semi under the label “Other Models.” That opacity has pushed analysts and media outlets toward rough triangulation. Cox Automotive estimates global Cybertruck sales at just under 39,000 units in 2024, sliding to roughly 20,000-20,200 in 2025. On that basis, the Cybertruck likely accounted for about 45-50 percent of “Other Models” in 2024 and around 40 percent in 2025, with the remainder split between the Model S/X and a small number of Semi trucks.

What Tesla plans to do with the freed-up production capacity is quite striking. Musk says the Fremont (California) production lines currently used for the Model S/X will be replaced by a facility intended to build Optimus, Tesla’s humanoid robot, part of an ambition to produce up to one million robots per year. Musk first unveiled Optimus at Tesla AI Day 2021, pitching it as a machine designed to take over physically demanding, repetitive, or dangerous tasks - starting in factories and, later, in homes. Yet the project is not fully living up to its hype: Musk has recently acknowledged that Optimus has not reached the promised productivity and is currently operating at about half the speed of a human.

Still, investor appetite suggests the broader humanoid-robotics bet is accelerating. In 2025, funding for humanoid robot startups reached $2.65 billion, more than the total invested from 2018 through 2024 combined. The message from capital markets is clear: humanoid robotics is shifting from a cautious experiment to a technology investors increasingly view as commercially ready.

You will find more infographics at Statista

You will find more infographics at Statistaby Tristan Gaudiaut,

Feb 3, 2026

The market for humanoid robots has been growing significantly recently. In 2025, $2.65 billion was invested in humanoid robotics startups, more than in the years 2018 to 2024 combined, according to data published by the market research platform Tracxn. This development indicates that investors now view humanoid robotics as a more mature and commercially attractive technology.

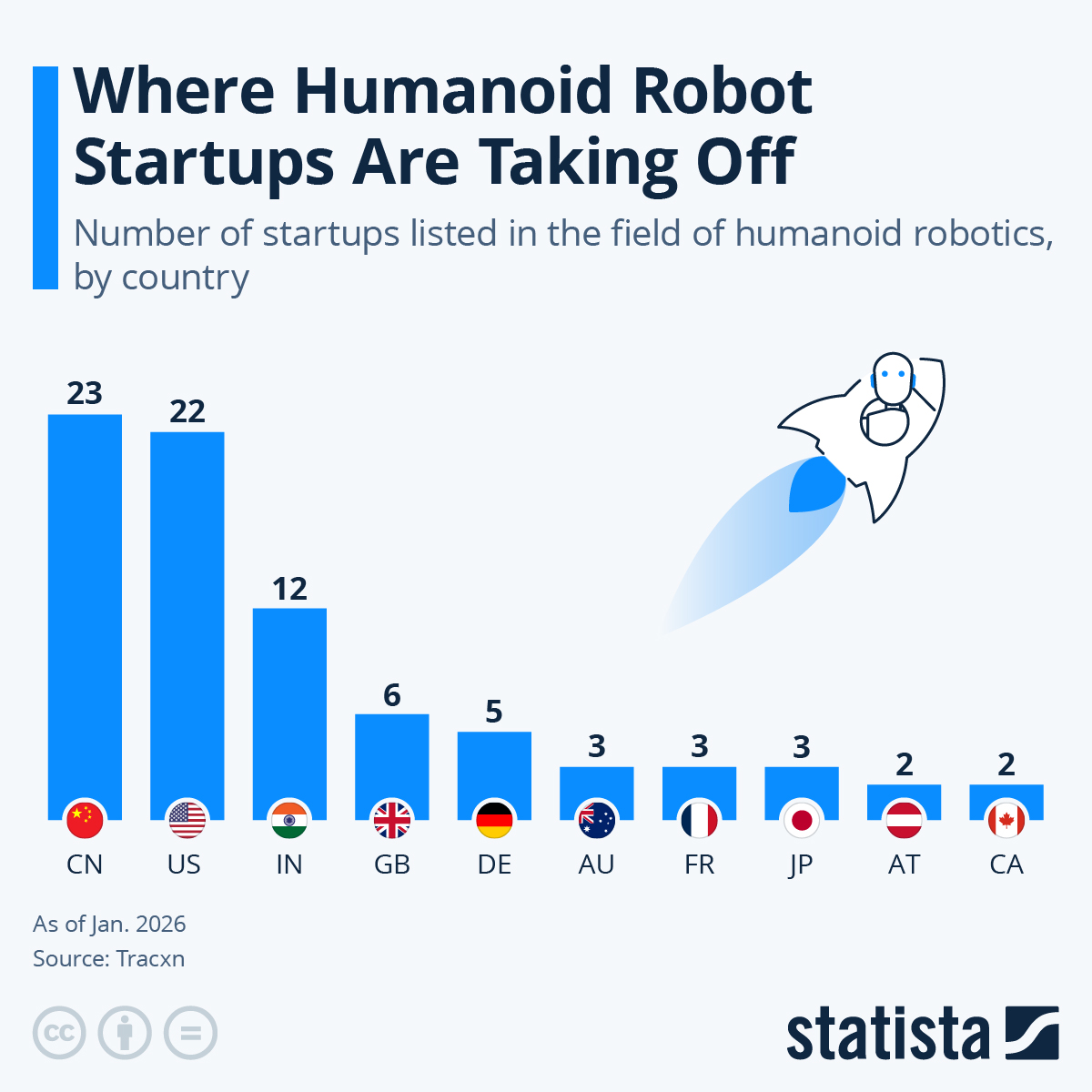

China currently leads the field with 23 startups specialized in humanoid robotics, just ahead of the 22 U.S.-based companies. While China and the United States are the clear epicenters for humanoid-robotics entrepreneurship, a second tier is led by India (12), ahead of several European countries: the U.K. (6) and Germany (5) stand out, followed by France (3). Beyond these hubs, our chart also shows clusters in Australia (3), Japan (3), Austria (2) and Canada (2), suggesting that while interest is global, the densest startup ecosystems remain concentrated in a handful of markets.

The Chinese and American startup ecosystem is particularly notable in this field. Chinese companies such as Unitree Robotics and Agibot are currently producing more humanoid robot models than any other country in the world (more than 5,000 each in 2025), while some of the best-known U.S. names, like Boston Dynamics and Tesla, are aiming to ramp up their production of robots for industrial and consumer applications in 2026 (Atlas and Optimus, respectively). In Europe, current key players include Engineered Arts (U.K.) and Neura Robotics (Germany).

You will find more infographics at Statista

You will find more infographics at StatistaChina's industrial robotics sector has surged ahead in recent years, cementing its position as the global leader in both the installation and operational stock of industrial robots. According to the latest World Robotics report published by the International Federation of Robotics, China accounted for 54 percent of all new robot installations worldwide in 2024, with a record of 295,000 units installed. As our chart shows, this represents more than double the number installed by Japan, the United States, South Korea and Germany combined (almost 140,000 installations together), which are the other four robotic powers in the world.

This brings China's operational stock of industrial robots to over 2 million, representing nearly half of the global stock (4.66 million units in 2024). Compared to the second in the ranking, Japan (around 450,000 units in 2024), the Chinese industry now has more than four times as many robots.

The country's rapid adoption of automation is driven by ambitious state-backed initiatives, such as "Made in China 2025", launched a decade ago and constituting the cornerstone of its massive investment in robotics. In 2023, China reached the third rank in industrial robot density, with 470 operational robots per 10,000 employees, surpassing both Germany and Japan. Only Singapore and South Korea remained ahead (700 to 1,000 robots per 10,000 employees).

Furthermore, if Japan remains the largest manufacturer of industrial robots, according to IRF, accounting for 38 percent of global production in 2024, China is gradually gaining ground. For example, Chinese manufacturers have almost doubled their domestic market share over the last decade, now supplying nearly 60 percent of the robots installed in the country, compared to just under 30 percent ten years ago.

You will find more infographics at Statista

You will find more infographics at Statistaby Tristan Gaudiaut,

Feb 3, 2026

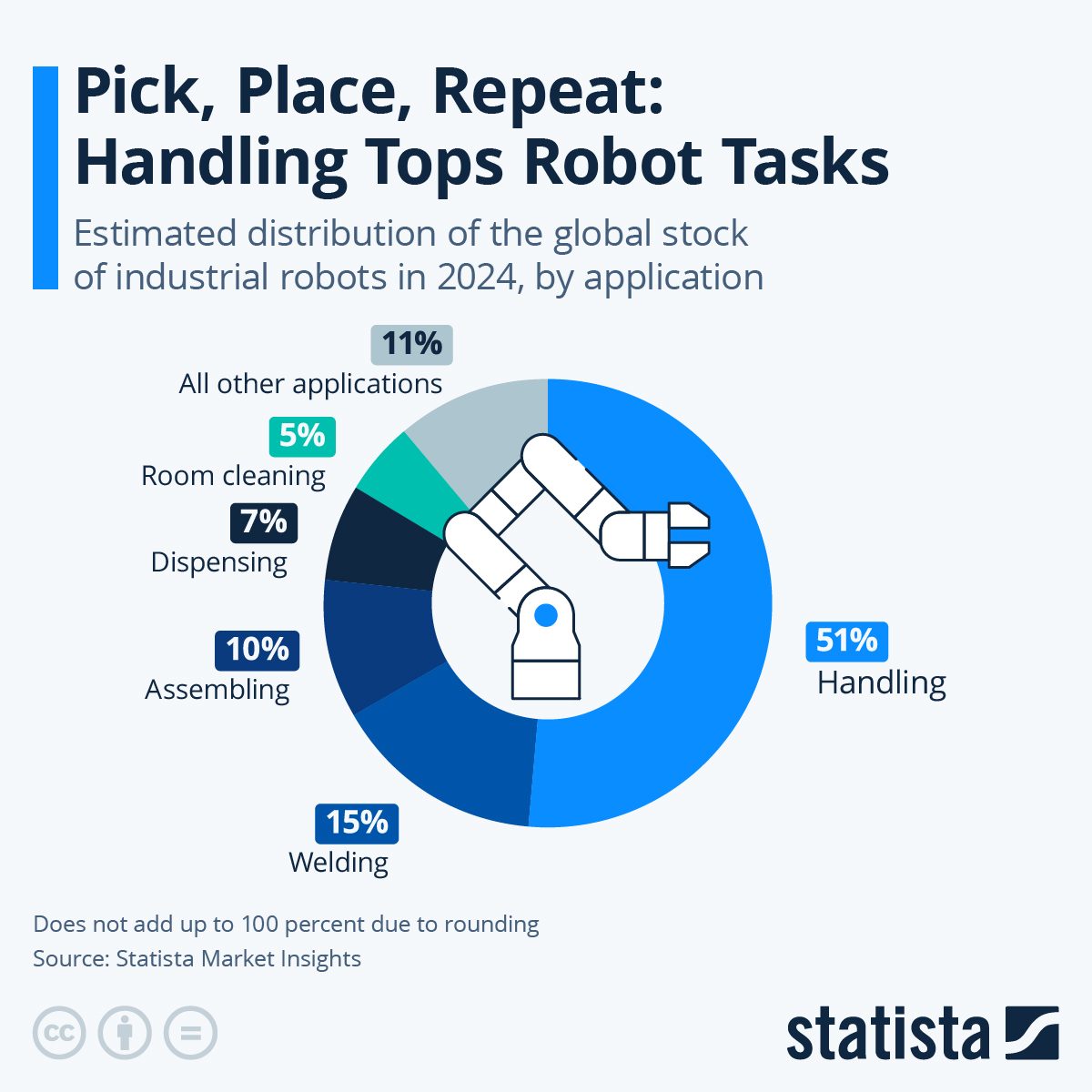

While robots continue to transform global manufacturing, handling tasks - such as picking, placing and moving materials - remain by far the leading industrial automation application. According to estimates from Statista Market Insights, this segment accounted for over half (51 percent) of all industrial uses worldwide in 2024. In comparison, that same year, the two other more popular applications: welding (15 percent) and assembling (10 percent), were together roughly half as prominent. This distribution underscores the ongoing automation of repetitive, labor-intensive processes, especially in sectors like automotive, logistics and electronics. Among the other industrial robot applications on the rise, we can also mention room cleaning, which accounted for around 5 percent of global uses in 2024.

You will find more infographics at Statista

You will find more infographics at Statista

China, India, Japan and many European countries will be strongly pressured to create robots and AI to handle their top-heavy elderly populations. With our resources that can integrate immigrants we can surround ourselves with humans rather than robotic slaves, and AI task masters. Make no mistake about it, other humans through AI will increasingly become our masters unless we are surrounded by other human beings rather than robots.

ReplyDelete