STATISTA: Tariff Crash Among Largest in 21st Century

by Felix Richter,

Apr 7, 2025

As markets across Asia and Europe went from bad to worse on Monday, Wall Street is bracing for another day of selloffs after President Trump showed no signs of backpedaling in the wake of last week's tariff-induced market turmoil. After European stocks clawed back from steeper losses through the trading day on Monday, the S&P 500 opened at 4,954 points, down 2.4 percent from Friday's close and 12.6 percent from Wednesday's close, the last before Trump's "Liberation Day" announcements. Depending on how the day unfolds, the index could clock the worst three-day loss since the financial crisis, when the S&P 500 plummeted 14 percent over three trading days in October 2008.

Considering the carnage we’ve seen over the last few weeks and since Trump's "Liberation Day" tariff announcement in particular, it’s hard to imagine that the U.S. stock market was at an all-time just six weeks ago. Since February 19, when the S&P 500 closed at 6,144 points, the index has now dropped almost 20 percent, bringing it on the verge of bear market territory, which is commonly defined as a 20-percent drop from an index's latest high.

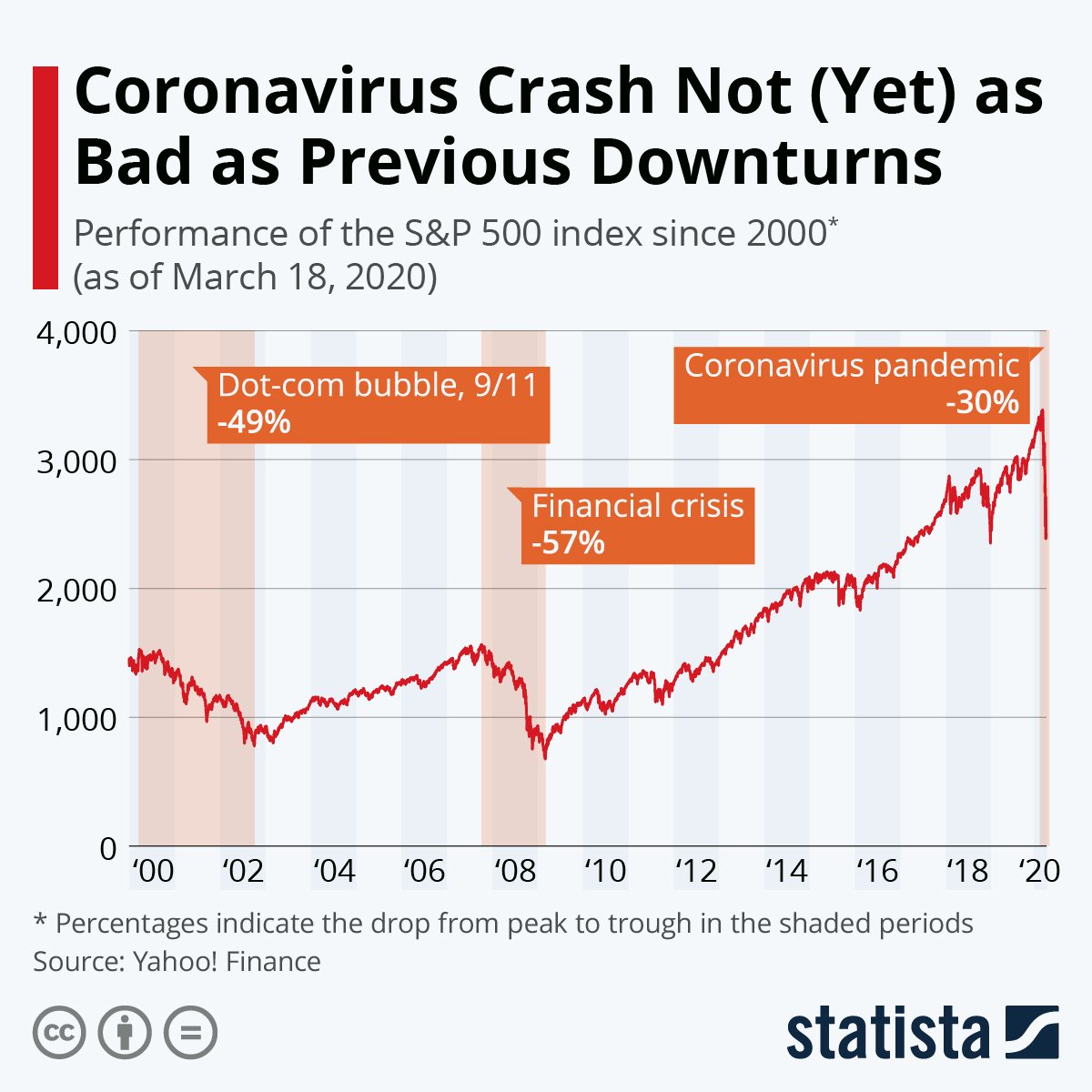

As the following chart shows, the drop we’ve seen over the past six weeks is already among the larger market downturns of the 21st century, but it’s not yet as deep as the worst crises of the past 25 years. Considering how quickly investors turned sour and how far-reaching the consequences of Trump's latest tariff hikes are, the past three days could just be the beginning of a longer market depression though, as fears of a global recession are already mounting.

While markets are reeling from the tariff panic, President Trump showed no signs of doubt over whether his protectionist push was the right move. The tariffs already in place are "a beautiful thing to behold," he wrote in a Truth Social post late on Sunday. "The United States has a chance to do something that should have been done decades ago," he added Monday morning, saying that "greatness" would be the eventual result.

You will find more infographics at Statista

You will find more infographics at Statista

Actually, it comes in fifth. Much smaller than 9/11 and the financial crises at the end of the Bush administration. The Biden inflation market was also worse than this has been so far. Covid was also worse though very brief.

ReplyDeleteSo, the question really is about how long this lasts and how much deeper it might get.

The markets like predictability, and that is something that might be difficult to get from Trump. As one commentator said, if the markets end up with predictable tariffs, then businesses can plan. If Trump is constantly changing the tariffs as he negotiates, then businesses are going to be worried about investing.

If this downturn is brief and Trump can point to some accomplishments it might not make a difference in the next presidential election. Although Biden did manage inflation as best he could, he really did not get credit for it. Many market experts thought Trump was going to get all the benefits of Biden's policies until now.

I still think Republicans are very likely to lose the House. Many voters whose retirement funds are in jeopardy are going to decide that a Democratic House might have been able to prevent this.

A couple of Interesting things; Musk is saying he wants zero tariffs.

ReplyDeleteThe other interesting thing, on the MSNBC site:

"A GOP House bill to give Congress more authority over tariffs will be introduced Monday despite President Donald Trump vowing to veto the upper chamber's version of the bill."

"Centrist Rep. Don Bacon (R-NE) is set to introduce a companion bill that would mirror the legislation authored last week by Sens. Maria Cantwell (D-WA) and Chuck Grassley (R-IA) to combat Trump’s sweeping tariff announcement last week. "

If the bill passes both chambers Trump is vowing to veto it.

I saw an article recently that made these points about tariffs:

Delete* The Constitution vests the authority to impose tariffs with Congress

* At the inception of the Great Depression, while Herbert Hoover was in the White House, Congress passed the Smoot Hawley legislation, which imposed protectionist measures, including tariffs

* The Smoot Hawley legislation exacerbated the Great Depression. In reaction, Congress ceded much its authority over tariffs to the President. The thought at that time - and it worked until, well, 2025 - was that Congressional representatives naturally find tariffs attractive, e.g. to protect the jobs of workers in their districts, as when their district includes large factories such as auto assembly plants. By contrast, the president is beholden to the well-being of the entire country rather than a particular employer or industry, and so is naturally anti-tariff. (From a Catholic perspective, we might consider this a Common Good approach.)

FWIW, I think there is zero chance Trump would cede his tariff authority back to Congress; and virtually zero chance that either house of Congress, in its current configuration, would try to override the veto.

I don't think there is any chance of it passing either. I don't know, maybe it is a way of making a statement?

DeleteDepends upon how deep the downtown is. Once the drop in the stock market reaches over 50% they just may override his veto. Everyone hopes that Trump is just negotiating deals, and that this will soon be over.

DeleteAn early rally on Wall Street faded and the S&P 500 ended the day down 1.6 percent after the White House reaffirmed plans to impose high tariffs on China and other countries at midnight.

Looks like it is going to head into "bear" market territory and maybe stay there.

I often read Morningstar via the subscription available remotely through our library. I read it at home after signing in to the library website. I find their analyses to be fairly solid.

ReplyDeletehttps://www.morningstar.com/economy/what-weve-learned-150-years-stock-market-crashes

Anne, thanks for that Morningstar article. Just want to comment that, as the years tick by, the investment time horizon gets shorter. A market recovery that takes 7 or 8 years could have a real impact on my decision of when to retire.

DeleteSo angry about this stupid, stupid tariff program.

At least you have a few years for your retirement accounts to recover, Unless the worst case scenario happens and America becomes a true authoritarian country without free elections. Trumps Wall street supporters are starting to panic. Some GOP politicians are also. So far he’s doubling down. He loves power as much as he loves money - and himself. He’s reveling in bringing down the whole world right now.

DeleteThis article was helpful in explaining the complexity of tariffs.

ReplyDeletehttps://www.nytimes.com/2025/04/09/opinion/tariffs-china-iphone-apple.html

"Let’s start with a sense of the stakes. Apple has largely been the world’s most valuable company since 2011, and until Mr. Trump’s tariff threats, it was worth around 8 percent of the entire S&P 500. If your retirement is invested in index funds, Apple is your single biggest investment."

"Then let’s turn to the fact that moving production to the United States — the stated goal of Mr. Trump’s extreme tariff regime — is almost impossible for Apple. China is home to roughly 90 percent of Apple’s global production, and it’s the only country where Apple has made such extraordinary investments in people, machinery and processes over a quarter-century."

"Analysts at the firm Wedbush estimated that a domestically built iPhone would cost more than triple its current price tag, which would mean about $3,500. Worse, America simply lacks the manufacturing expertise, the competitive industrial clusters and even the population density required to make Apple products en masse."

"Many Apple suppliers are heavily reliant on China’s low-paid workers who migrate to cities for seasonal work, a number estimated at 300 million to 500 million adults, which even at its lower extent is nearly equivalent to every man, woman and child in the United States. In the busy holiday season, these workers are critical to Apple’s ability to ship one million iPhones per day, with each unit comprising roughly 1,000 components. Trying to move all manufacturing out of China would most likely cost hundreds of billions of dollars."

"So in 2016, when Mr. Trump was urging his supporters to boycott Apple products and threatening huge China tariffs, little wonder that Mr. Cook, a quiet Democrat and a strong supporter of L.G.B.T.Q. rights and diversity initiatives, went on a charm offensive. He made a point of calling Mr. Trump and visiting frequently. The next year, Mr. Trump said that Mr. Cook vowed to build “three big plants, beautiful plants” in America."

"The flattery worked, with Apple gaining broad exemptions from Mr. Trump’s tariffs. But Apple built zero plants in the United States. Its chief executive simply ran out the clock on Mr. Trump’s presidency."

"Apple is stuck, and there is no obvious way out. Even if it were possible for Mr. Cook to move Apple production out of China immediately, he would risk stirring Beijing’s ire and endangering a roughly $70 billion business there. His only option is to continue pushing more final assembly of Apple products to places like India and Vietnam while leaving the bulk of complex manufacturing in China — walking a line that grows ever thinner and more precarious. Apple shares have lost more than $1 trillion since peaking in late December."

I bought a new iphone recently but kept my old iphone6plus since it was of little trade in value and had some programs that are no longer available. Since I do not trade in phones frequently, I would not be averse to paying considerably more if that meant iphones would be manufactured in the US.

DeleteBut it would take Apple at least a decade perhaps a quarter of a century to remake itself into an American manufacturing company. In general, I would like to buy houses, cars, computers, etc. that would last decades rather than always becoming obsolete after a few years. It will take much more than tariffs to build the culture that supports that type of economy.

I've never owned anything Apple. Too expensive. I have android everything, right now my phone is Samsung. I suppose they're made in China too.

DeleteSamsung is a huge. Korean company. Our TV is Samsung.

DeleteWell, I'd rather it was Korean than Chinese.

DeleteApple doesn't have to bring its production back onshore. It can surely run out the clock on Trump's presidency again (although there is a risk that another MAGA Republican like JD Vance could succeed him).

DeleteBut Apple surely has not been wise to center such a large percentage of its manufacturing capacity in China. As of yesterday, Trump has sorta called off all the tariffs (leaving a 10% tariff more-or-less across the board) but has increased the China tariff to 100+%. As it looks today (and this could all change again by tomorrow), Trump has essentially instituted a trade war with China. Apple needs to spread its manufacturing across the world so it is less reliant on Chinese capacity. That is a very complex problem (all low-cost countries bring varying types and degrees of risk), and it would take a decade or more to execute. It's kind of unconscionable that it didn't start doing this at the start of Trump's first term.

Why make any long term investment based on Trump’s extreme moves and subsequent reversals? The quaint term “flibbertygibbet” applies to Trump. I don’t see the rest of the world trusting us ever again. And I’ve lost all confidence in the Democratic Party which seems to be still in its own bubble. Why I should vote for any party that supports dropping 85,000 tons of HE bombs on babies, children, and their parents is beyond my comprehension.

DeleteStanley, you were lucky enough to be a federal employee when the retirement system was far less vulnerable to market swings. Both of us deferred collecting social security until age 72 because we continued to work and didn’t want to be taxed on SS payments and because it had a guaranteed 8% return each year we didn’t collect. We are grateful for our SS. Fortunately we both liked to work . But most of our retirement is funded by 401ks and IRAs and we have to invest in something in order to have money beyond our SS - and that might even be cut also. Our friends who are old like us who are retired federal employees under the old system feel more secure than we do. The can choose not to invest - so far. But what if they come for the old style federal pensions too?

DeleteExactly, Anne. Nothing is sacred or secure anymore. I check my account at the first of the month to see if the pension was deposited. Two ways they can do in my CSRS pension.. Downsize the bureaucracy until the direct deposit doesn’t function or just do it by presidential fiat. Feelings of security are inappropriate during this Trump presidency. At the family Easter gathering, I plan to share my own feelings of insecurity with my two cousins on CSRS who voted for Trump. I have enough savings to last a few years but that could be wiped out if the dollar crashes. And I assume the medical insurance would be zeroed out, too. The rest of the world hates us and I don’t blame them.

DeleteSome terms for going forward. I had never heard of a “ dead cat bounce” before.

ReplyDeletehttps://apnews.com/article/bear-market-dead-cat-bounce-trade-war-terms-13e2a3f3445fcb11095aa722922140cf

I had never heard of a dead cat bounce either. And here's another one, "rat poison colonoscopy". That one is from comedian Jon Stewart.

DeleteSupposedly there is an investigation into insider trading with Trump and the stock market volatility. Martha Stewart had to serve jail time for insider trading. But she was just a regular citizen. The investigation won't go anywhere with the Trump administration. If there is a line they can't cross, I don't know what it would be.

Yeah, "dead cat bounce" has been around for a while. Speaking as a cat owner (or at least the husband of a cat owner): not a very nice image!

Delete